Create a Base Year Study (BYS) when you want to record QRE information from a prior year, but not calculate a credit for that year.

If this is a business's first time using the R+D application but not the first time claiming the R+D tax credit, it might be necessary to create a Base Year Study. These are simplified studies used to record activities preformed in prior years without the necessity of generating a credit.

BYS's can be used to accurately fill in base period values when calculating the credit for future years.

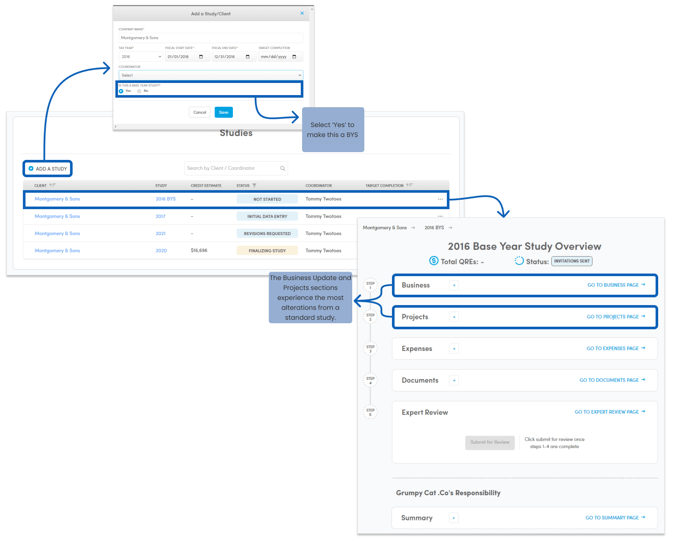

To create a base year study:

- From Practice Management, click Add a Study

- Enter client name, tax year, fiscal start, fiscal end, target completion (optional) and assign a coordinator from your team.

- Set Is This a Base Year Study? to Yes

- Note: An existing standard study can also be cloned to create a Base Year Study and vice versa.

- Click Save

- From the Studies Table, select your new study to be taken to the Study Overview.

- Note: Notice that the calculation section has been removed and that 'Estimated Credit' has been replaced by Total QREs.

- The client can now enter information in the same way as with a regular study except with a few changes to a some of the sections:

- Business Update asks for only Grants and Funding and the Gross Receipts for the year.

- Projects ask a smaller number of qualification questions.

- Final Reports can no longer be generated from the Documents section.